When you want to take control of your finances and actually feel where your money is going, sometimes the most old-school methods are the most effective. Enter the Cash Envelope System — a simple, visual way to manage your spending, limit overspending, and stay within your budget.

💡 What Is the Cash Envelope System?

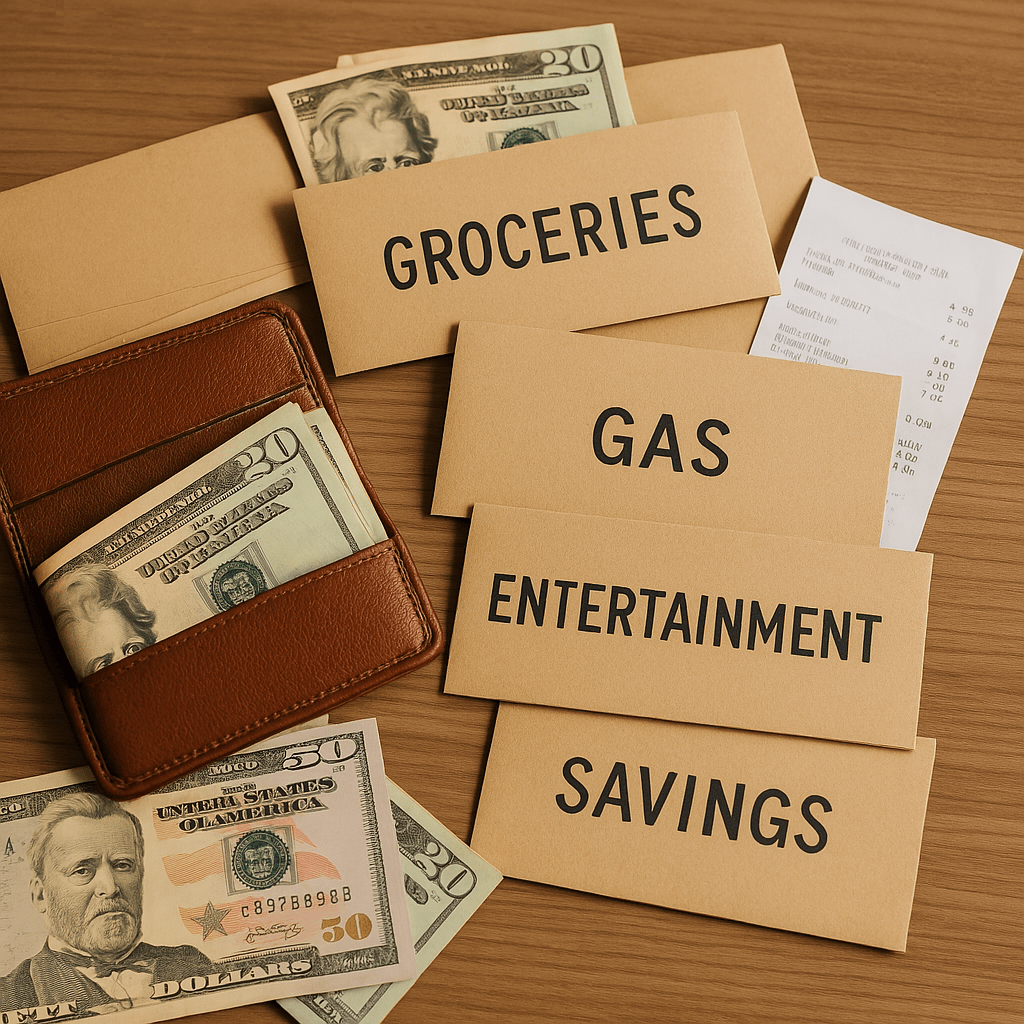

The cash envelope system involves physically dividing your monthly income into separate envelopes, each labeled with a specific spending category (e.g., “Groceries,” “Gas,” “Dining Out”). Once an envelope is empty, you stop spending in that category until the next month.

This method creates a tangible connection to your money — making it harder to overspend and easier to track where your funds are going.

🔗 New to budgeting? Start here: How to Create a Monthly Budget That Works for You

🧾 How It Works – Step-by-Step

1. Set Your Budget

Based on your income, determine how much you’ll spend in each category:

- Groceries – $400

- Gas – $150

- Fun – $100

- Dining Out – $120

2. Withdraw Cash

Take out your budgeted total in cash at the beginning of the month (or paycheck cycle).

3. Label Your Envelopes

Use physical envelopes or wallet dividers. Label each one clearly.

4. Use Only What’s in the Envelope

Once the money in that envelope is gone, that’s it for the month.

✅ Benefits of the Envelope Method

- Visual discipline: You see exactly what’s left for each category.

- No hidden fees or overdraft surprises

- Helps break the credit/debit card cycle

- Prevents emotional or impulse spending

- Encourages intentional purchases

🔗 Want to cut unnecessary costs? Check out Smart Spending Strategies

🔁 Digital Alternatives

While this method is traditionally cash-based, many apps mimic the envelope system:

- Goodbudget

- Mvelopes

- YNAB (You Need A Budget) — uses digital “envelopes” for proactive spending.

🔗 Prefer going digital? Explore the Best Budgeting Apps for 2025

🚧 Common Mistakes to Avoid

- Not budgeting categories accurately — Always base on past spending patterns.

- “Borrowing” between envelopes — This defeats the purpose.

- Forgetting irregular expenses — Budget for birthdays, medical, car maintenance, etc.

🔗 Build your buffer with How to Build an Emergency Fund

👛 Is the Cash Envelope System Right for You?

✅ Perfect if you:

- Overspend with cards

- Need strict structure

- Prefer analog, visual tracking

- Are paying off debt or living on a tight budget

⚠️ May not be ideal if:

- You pay bills online or do all banking digitally

- You dislike handling cash

- You travel often or live cash-free

🧠 Final Thoughts

The Cash Envelope System is simple, visual, and effective — especially for those trying to rein in spending or reset their relationship with money. It gives you permission to spend — but within boundaries you set yourself.

Whether you’re saving for a goal, trying to stay debt-free, or just want more control, this method helps you stay grounded and focused.

🔗 Want to build wealth regardless of income? Read: Building Wealth on Any Income

Leave a reply to Sinking Funds: The Budgeting Trick That Prepares You for Big Expenses Without Stress – Smart Finance Hub Cancel reply