Introduction

Have you ever wondered how some investors grow their wealth significantly over time without constantly adding more money? The secret lies in compound interest—one of the most powerful financial concepts that can turn small savings into substantial wealth. Whether you’re new to investing or looking to maximize your returns, understanding compound interest is key.

1. What Is Compound Interest?

Compound interest is the process where your earnings (interest or investment returns) are reinvested to generate even more earnings. In simple terms, you earn interest on both your initial investment and the interest you’ve already earned.

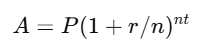

🧮 Formula for Compound Interest:

Where:

🔹 A = Final amount

🔹 P = Principal (initial investment)

🔹 r = Annual interest rate (decimal form)

🔹 n = Number of times interest is compounded per year

🔹 t = Number of years

👉 Example: If you invest $1,000 at 5% annual interest, compounded annually for 10 years, your investment grows to $1,628.89, without adding any extra money!

2. The Magic of Starting Early

Time is the most crucial factor in compounding. The earlier you start, the greater your returns.

📌 Example Comparison:

- Investor A invests $5,000 annually from age 25 to 35 (10 years) and then stops.

- Investor B invests $5,000 annually from age 35 to 65 (30 years).

- Despite investing for only 10 years, Investor A ends up with more money at retirement because of compound interest!

Starting your investment journey

🚀 Lesson: Even small investments can grow into a fortune over time. Start now, no matter how little you can invest.

3. Simple vs. Compound Interest: The Key Difference

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Growth Rate | Linear | Exponential |

| Earnings Based On | Principal Only | Principal + Interest Earned |

| Example (10 Years, 5% Interest on $1,000) | $1,500 | $1,628.89 |

👉 Key Takeaway: Compound interest accelerates wealth growth significantly over long periods.

4. Where to Apply Compound Interest in Your Investments

Not all investments benefit from compounding the same way. Here are the best options:

✅ Stocks & ETFs—Reinvesting dividends boosts long-term returns.

✅ Retirement Accounts (401(k), IRA)—Tax advantages + compounding create powerful growth.

✅ High-Yield Savings Accounts—Safer option with small but steady compounding.

✅ Bonds & Fixed Deposits—Some offer compounded interest over time.

🚀 Pro Tip: Always reinvest your earnings instead of withdrawing them to maximize compounding!

5. Maximizing Compound Interest Returns

To make the most of compounding, follow these strategies:

🔹 Start Early: Even small contributions grow exponentially over time.

🔹 Increase Contributions: Invest regularly to accelerate growth.

🔹 Reinvest Earnings: Keep your interest working for you.

🔹 Choose High-Compounding Investments: Look for options with frequent compounding periods (daily, monthly).

🔹 Stay Consistent: The longer you stay invested, the greater your returns.

Conclusion

Compound interest is a wealth-building powerhouse. Whether you’re saving for retirement, a major purchase, or simply growing your investments, understanding and applying compound interest can make a huge difference.

📌 Take Action Now:

✅ Start investing as early as possible

✅ Reinvest your earnings to accelerate growth

✅ Stay committed to long-term investment strategies

💬 How are you leveraging compound interest in your financial journey? Let us know in the comments!

Leave a reply to The Ultimate Guide to Value Investing: How to Find Undervalued Stocks and Build Long-Term Wealth – Smart Finance Hub Cancel reply