Before you can buy Bitcoin, trade altcoins, or stake crypto — you need to use a crypto exchange. These platforms serve as the gateway between users and the world of digital assets.

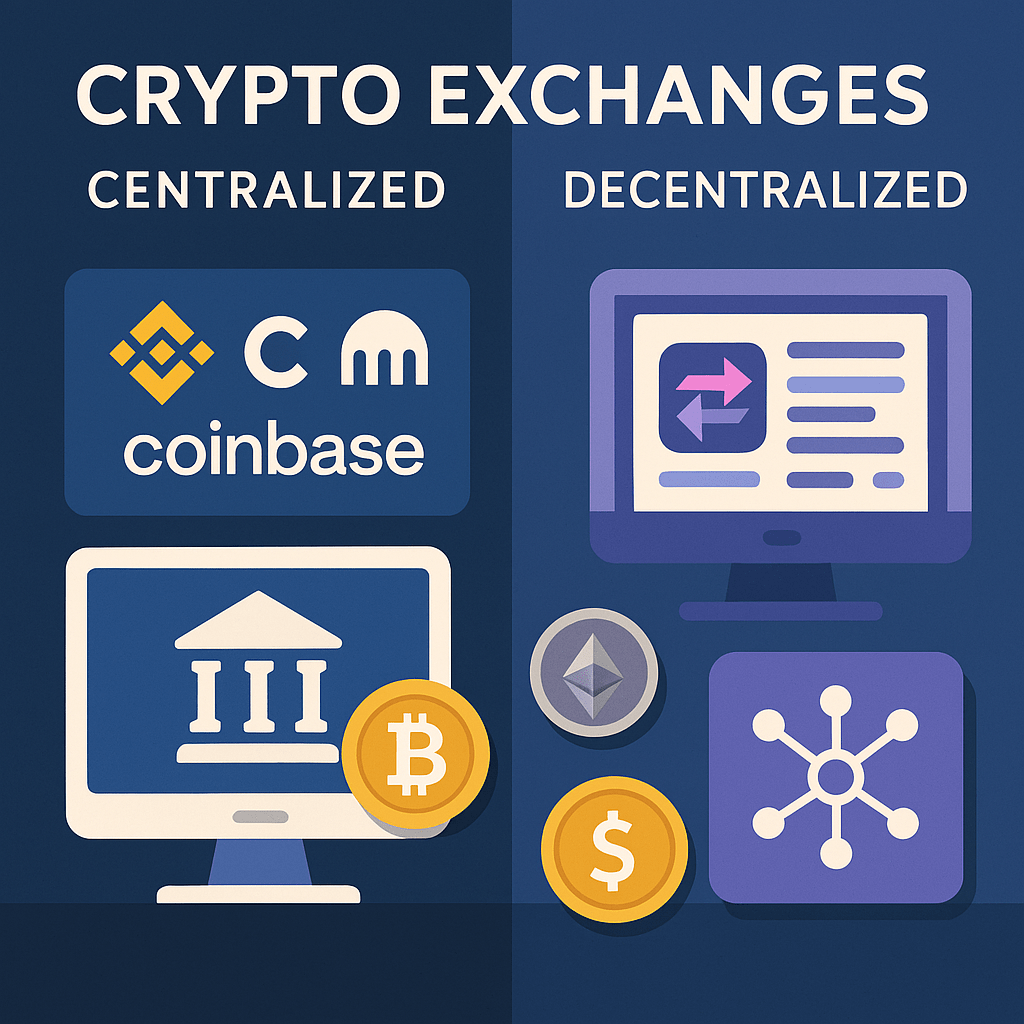

But not all exchanges are built the same. There are two main types: centralized (CEX) and decentralized (DEX) — and each has its own pros, cons, and ideal use cases.

Let’s explore how they work and how to choose the best option for your goals.

💡 What Is a Crypto Exchange?

A crypto exchange is a platform that allows users to:

- Buy and sell cryptocurrencies

- Convert crypto to fiat and vice versa

- Trade one crypto asset for another

- Use financial tools like margin, futures, and staking (on some platforms)

🏛️ Centralized Exchanges (CEX)

🔹 What Are They?

Centralized exchanges are run by companies that act as middlemen between buyers and sellers. Users create accounts, deposit funds, and trade through the platform’s interface.

🔹 Popular CEXs:

- Binance

- Coinbase

- Kraken

- Bybit

- OKX

✅ Pros:

- User-friendly for beginners

- High liquidity and fast execution

- Fiat on-ramps (buy with credit/debit card)

- Customer support and mobile apps

❌ Cons:

- Custodial: You don’t control your private keys

- Subject to regulation and KYC

- Risk of hacks or platform failure

🔗 Want to protect your holdings? Read How to Secure Your Crypto Assets

🌐 Decentralized Exchanges (DEX)

🔹 What Are They?

DEXs are smart-contract-based platforms that allow peer-to-peer crypto trading — without intermediaries. You connect your wallet (like MetaMask), sign a transaction, and swap assets directly.

🔹 Popular DEXs:

- Uniswap (Ethereum)

- PancakeSwap (BNB Chain)

- SushiSwap

- Curve

- GMX (Arbitrum)

✅ Pros:

- Non-custodial: You control your assets at all times

- No KYC — greater privacy

- Access to early-stage tokens and DeFi protocols

❌ Cons:

- Less beginner-friendly

- Slower, higher gas fees (especially on Ethereum)

- Lower liquidity for small tokens

- Greater risk of scam tokens or poor project vetting

🔗 Want to learn how DEXs work? Start with What Is DeFi?

⚖️ CEX vs DEX: Key Differences

| Feature | Centralized (CEX) | Decentralized (DEX) |

|---|---|---|

| User control | Platform holds funds | You hold private keys |

| KYC required | ✅ Yes | ❌ No |

| Ease of use | ✅ Beginner-friendly | ⚠️ More technical |

| Liquidity | ✅ High | Varies by token |

| Security | ❌ Hack risk | ✅ More secure (if used properly) |

| Fees | Low to moderate | Gas fees (can be high) |

🛠️ How to Choose the Right Exchange

Ask yourself:

- Are you new to crypto? → Start with a CEX

- Do you want full control over your keys? → Explore DEXs

- Do you plan to invest long-term or trade actively?

- Do you need fiat on-ramps (USD, EUR)?

A hybrid strategy works too:

✅ Use CEX for buying and cashing out

✅ Use DEX for trading, privacy, and DeFi access

🧠 Tips for Safe Trading

- Always enable 2FA on centralized platforms

- Store large amounts in cold wallets, not on exchanges

- Double-check token addresses when using DEXs

- Avoid unknown or unverified exchanges and projects

🚀 Final Thoughts

Crypto exchanges are the bridge between you and the blockchain economy. Whether you go centralized or decentralized, understanding how these platforms work helps you make smarter, safer choices.

As the crypto space matures, hybrid models (like Binance DEX or Coinbase Wallet) are blending the best of both worlds — making crypto more accessible while keeping users in control.

🔗 Ready to invest? Start with Crypto Investment Strategies

Leave a comment